Hualilan Gold Project – San Juan, Argentina

Argentina

San Juan province is the leading gold producer and the most pro-mining province in the Argentine Republic. The geological potential of the province is backed by a proactive Mining Ministry and strong Governmental support. In addition to a number of producing gold mines San Juan Province hosts world class copper deposits such as Josemaria (Lundin Mining), Filo del Sol (Filo Mining) El Pachón (Glencore), and Los Azules (McEwen Mining).

Hualilan Gold Project

Maiden Mineral Resource Estimate (“MRE”) of 2.8 million ounces (AuEq1) in a well known mining district1. This MRE included a high-grade core of 1.6 million ounces at 5.0 g/t AuEq.

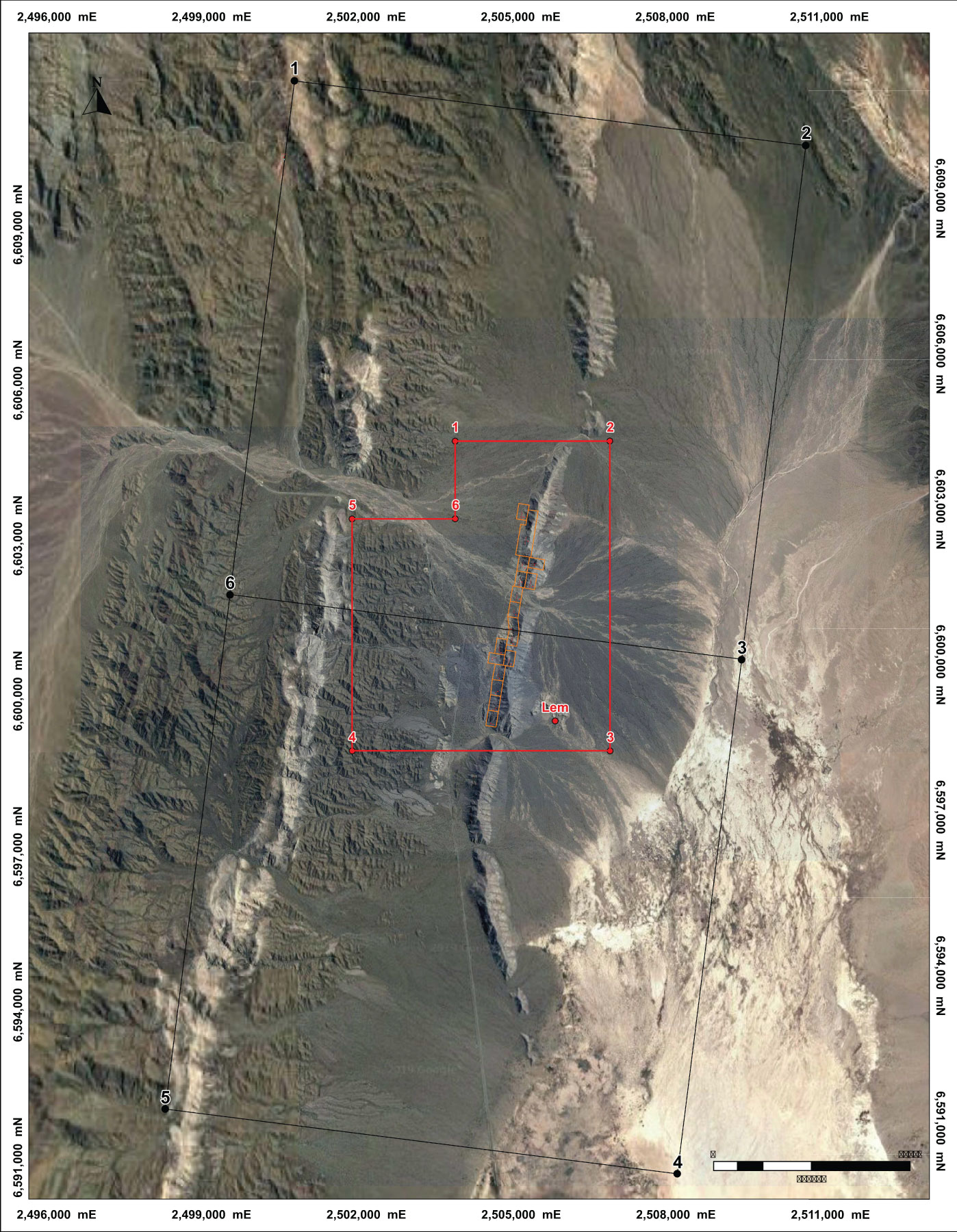

The Hualilan (local indigenous name for “land of gold”) Gold Project is located in San Juan province Argentina. All of the upgraded 2023 MRE is located on Mina’s or Mining Licenses while the overall Hualilan Gold Project consists of a district scale 600 square kilometres of tenements.

This is held via a combination of:

- 235 square kilometres granted to the Company containing the upgraded 2023 MRE; and strike extensions 5 kilometres north and south.

This includes 15 granted mining leases which contain the bulk of the 2.8 million ounce MRE; and - 329 square kilometres pending formal grant to the Company which has been registered to CEL in the Mining Cadastre of San Juan.

Hualilan has extensive historical drilling with in excess of 188 drill-holes dating back to the 1970s which complement the 900 holes drilled by Challenger Gold. The property was last explored by La Mancha Resources, a Toronto Stock Exchange listed company, in 2004. La Mancha’s work resulted in a NI43-101 (non-JORC) resource estimate of ~627,000 Oz Au at 13.7 g/t gold1 that remains open in most directions.

1 Gold Equivalent (AuEq) values – Requirements under the JORC Code

- Assumed commodity prices for the calculation of AuEq is Au US$1900 Oz, Ag US$24 Oz, Zn US$4,000/t, Pb US$2000/t

- Metallurgical recoveries are estimated to be Au (95%), Ag (91%), Zn (67%) Pb (58%) across all ore types (see JORC Table 1 Section 3 Metallurgical assumptions) based on metallurgical test work.

- The formula used: AuEq (g/t) = Au (g/t) + [Ag (g/t) x 0.012106] + [Zn (%) x 0.46204] + [Pb (%) x 0.19961]

- CEL confirms that it is the Company’s opinion that all the elements included in the metal equivalents calculation have a reasonable potential to be recovered and sold

Location and Access

The Hualilan Project is located approximately 120km north-northwest of San Juan, the capital of San Juan Province in north-western Argentina.

Logistics are excellent with the Project accessible via sealed roads to within 500 metres of the licence and then by a series of unsealed roads around the licence. The closest town on the power grid is approximately 40km to the north of the Hualilan Project.

The project is located at an elevation of approximately 1700m. The climate is moderate and dry with rain most common from December to January. The area is sparsely populated, vegetation is thin and geology is well exposed at surface. Field operations are possible year-round.

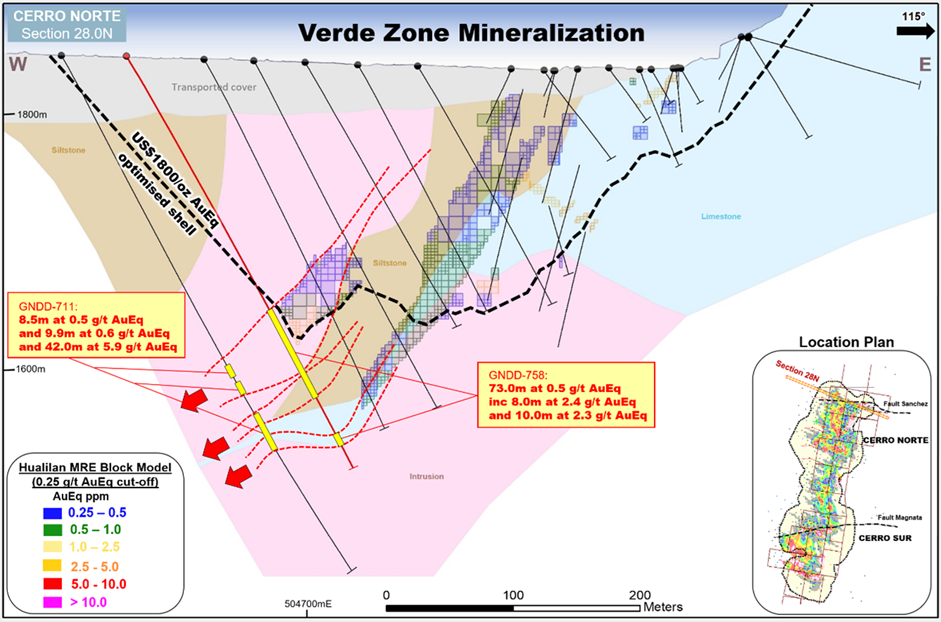

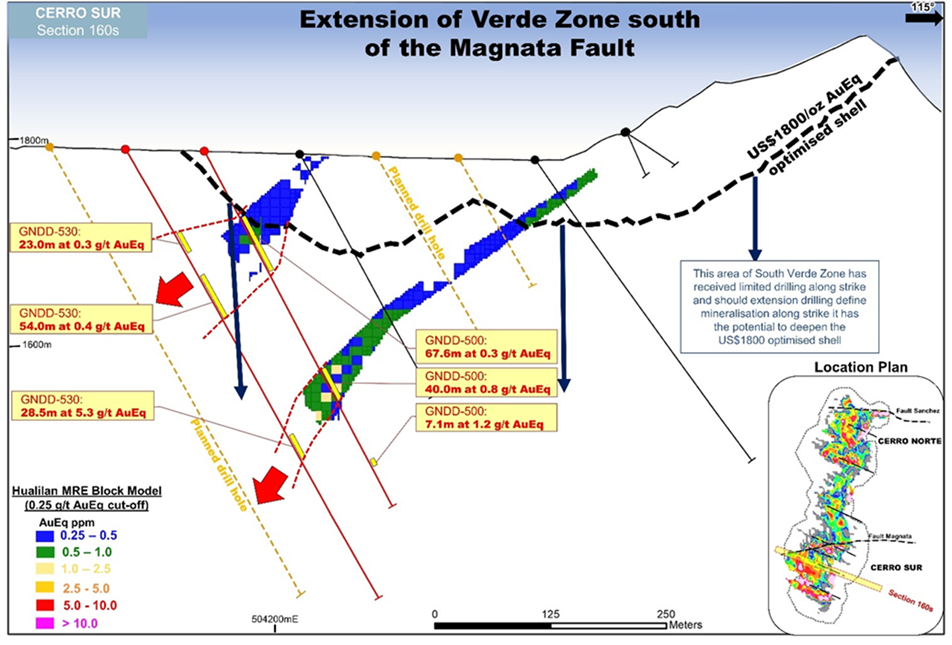

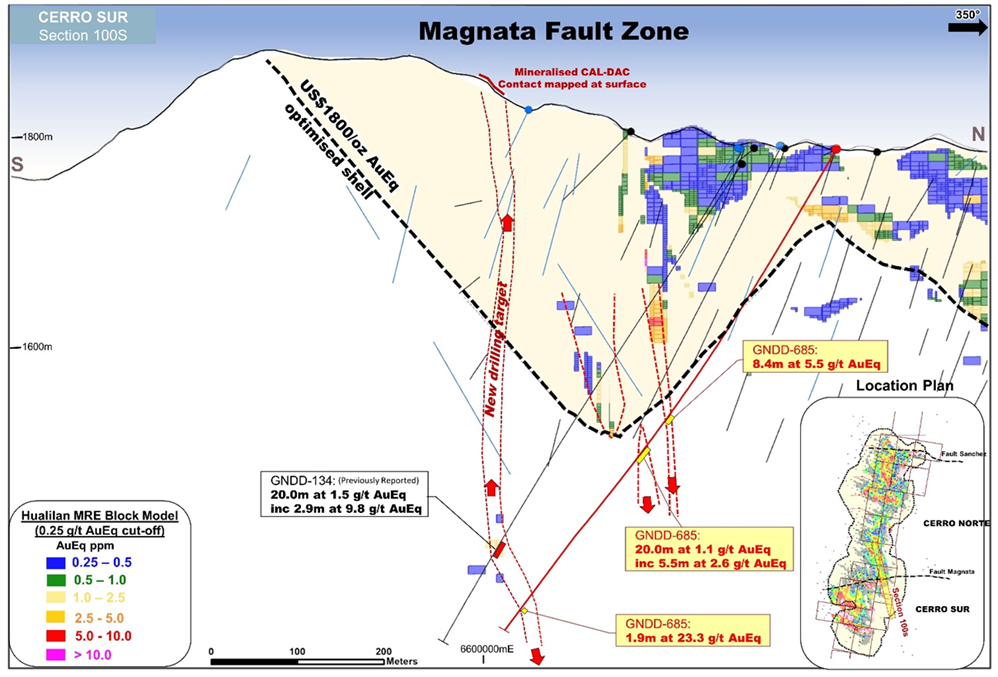

Geology and Mineralisation

The Project is the site of extensive zinc skarn mineralisation with a gold overprint which makes it a somewhat unique style of mineralisation.

Commonly zinc skarns occur in continental settings associated convergent tectonic plate margins as is the case at Hualilan, located in the pre-cordillera of the western South American convergent plate margin. Zinc skarns commonly contain high grade zinc, lead, and silver although zinc is usually dominant. Mineralisation and skarn alteration at Hualilan occurs in all three main rock types.

- Limestone (San Juan Formation of Ordovician age) contains high grade mineralisation (manto style) controlled by bedding parallel faults, cross faults, and contacts with other rock types.

- Shale and sandstone (of Silurian age) contains lower grade replacement style skarn mineralisation which preferentially occurs parallel to bedding with 30m of the Limestone contact.

- Dacitic intrusions (of Mid-Miocene age) contain stockwork fracture and locally breccias which host lower grade skarn mineralisation.

In all host rocks, the zinc skarn mineralisation is overprinted by a slightly later phase of gold – silver mineralisation. This second phase of mineralisation is mesothermal to deep epithermal and may be related to but is separate from the zinc skarn. Importantly, the gold mineralisation is deposited in the same reactivated faults and fractures as the zinc skarn. Precise mineral paragenesis and hydrothermal evolution of the deposit is the subject of on-going work which is being used to guide exploration and detailed geometallurgical test work.

The dacitic intrusions which are part of the host rock sequence at Hualilan may be related to the hydrothermal activity that formed the skarn, although the timing relationships have not been determined. At this stage, we use the term “intrusion-hosted” rather than “endoskarn” to describe the skarn mineralisation in the dacite.

Gold occurs in native form as inclusions with sulphide (predominantly pyrite) and in pyroxene-garnet skarn alteration. The mineralisation commonly occurs with pyrite and the zinc skarn assemblage of sphalerite and galena with rare chalcopyrite, pyrrhotite and magnetite. Importantly, mineralisation contains very low levels of arsenic, mercury, and other deleterious metals.

Complete oxidation of the surface rock due to weathering is thin. A partial oxidation/fracture oxidation layer near surface is 1 to 40m thick and has been modelled from drill hole intersections. Where oxidation is more intense, native gold can be observed. This oxide mineralisation has been the subject of past mining at Hualilan with an unknown amount of gold having been extracted by washing and more recently by vat leach.

Exploration

Intermittent sampling dating back over 500 years has produced a great deal of data including sampling data, geologic maps, reports, trenching data, underground workings, drill hole results, geophysical surveys, resource estimates plus property examinations and detailed studies by several geologists although, prior to CEL, no work has been completed since 2006.

- 1984 – Lixivia SA channel sampling & 16 RC holes (AG1-AG16) for 2040m

- 1995 – Plata Mining Limited (TSE: PMT) 33 RC holes (Hua- 1 to 33) + 1500 samples

- 1998 – Chilean consulting firm EPROM (on behalf of Plata Mining) systematic underground mapping and channel sampling and resource estimate

- 1999 – Compania Mineral El Colorado SA (“CMEC”) 59 core holes (DDH-20 to 79) plus 1700m RC program and resource estimate

- 2003 – 2005 – La Mancha (TSE Listed) undertook 7447m of DDH core drilling (HD-01 to HD-48) and resource estimate

In addition to 188 historical drill holes there is 6km of underground workings that pass through mineralised zones all of which have been mapped and sampled.

Since The Company acquired the Hualilan Gold project it has completed over 900 drill holes for 220,000 metres of predominantly diamond core drilling, undertaken an extensive program of metallurgical testwork, and commenced a Scoping Study. The go forward program includes a Pre-Feasibility Study, regional exploration along the previously unexplored 30 kilometres of prospective stratigraphy, followed by a Bankable Feasibility-Study.

Mineral Resource Estimate (MRE)

Mineral Resource Estimate (MRE) which is reported according to JORC (2012) for the Company’s flagship Hualilan Gold Project, in San Juan Argentina:

Table 1 – Upgraded Hualilan MRE, March 2023

| Domain | Category | Mt | Au g/t | Ag g/t | Zn % | Pb % | AuEq1 g/t | AuEq1 (Mozs) |

| US$1800 optimised shell | Indicated | 45.5 | 1 | 5.1 | 0.4 | 0.06 | 1.3 | 1.9 |

| > 0.30 ppm AuEq | Inferred | 9.6 | 1.1 | 7.3 | 0.4 | 0.06 | 1.2 | 0.4 |

| Below US$1800 shell >1.0ppm AuEq | Inferred | 5.5 | 2.1 | 10.7 | 1 | 0.06 | 2.6 | 0.5 |

| Total | 60.6 | 1.1 | 6 | 0.4 | 0.06 | 1.4 | 2.8 | |

Note: Some rounding errors may be present

1 Gold Equivalent (AuEq) values – Requirements under the JORC Code

- Assumed commodity prices for the calculation of AuEq is Au US$1900 Oz, Ag US$24 Oz, Zn US$4,000/t, Pb US$2000/t

- Metallurgical recoveries are estimated to be Au (95%), Ag (91%), Zn (67%) Pb (58%) across all ore types (see JORC Table 1 Section 3 Metallurgical assumptions) based on metallurgical test work.

- The formula used: AuEq (g/t) = Au (g/t) + [Ag (g/t) x 0.012106] + [Zn (%) x 0.46204] + [Pb (%) x 0.19961]

- CEL confirms that it is the Company’s opinion that all the elements included in the metal equivalents calculation have a reasonable potential to be recovered and sold

Table 2 – Total MRE at various cut off grades

Grade Tonnage Distribution

| Cut-off (g/t AuEq1) |

Mt | Au (g/t) |

Ag (g/t) |

Zn (%) |

Pb (%) |

AuEq1 (g/t) |

Moz (AuEq1) |

| 0.1 | 94,439,377 | 0.77 | 3.79 | 0.31 | 0.04 | 0.98 | 2,960,631 |

| 0.2 | 74,280,292 | 0.95 | 4.5 | 0.37 | 0.05 | 1.2 | 2,869,259 |

| 0.25 | 67,550,352 | 1.03 | 4.85 | 0.4 | 0.05 | 1.3 | 2,819,993 |

| 0.3 | 60,649,096 | 1.13 | 5.19 | 0.44 | 0.06 | 1.41 | 2,758,935 |

| 0.4 | 49,131,477 | 1.33 | 5.82 | 0.52 | 0.06 | 1.67 | 2,630,081 |

| 0.45 | 44,470,807 | 1.43 | 6.21 | 0.56 | 0.07 | 1.79 | 2,565,915 |

| 0.5 | 40,314,159 | 1.54 | 6.5 | 0.6 | 0.07 | 1.93 | 2,503,463 |

| 0.6 | 33,508,271 | 1.77 | 7.1 | 0.69 | 0.08 | 2.21 | 2,383,116 |

| 0.7 | 29,139,726 | 1.96 | 7.52 | 0.77 | 0.09 | 2.45 | 2,292,046 |

| 0.8 | 25,745,239 | 2.14 | 7.98 | 0.84 | 0.09 | 2.67 | 2,210,537 |

| 0.9 | 23,143,665 | 2.31 | 8.34 | 0.91 | 0.1 | 2.88 | 2,139,855 |

| 1 | 21,101,103 | 2.46 | 8.66 | 0.97 | 0.1 | 3.06 | 2,077,276 |

| 1.1 | 19,040,313 | 2.66 | 9.07 | 1.04 | 0.1 | 3.28 | 2,007,852 |

| 1.2 | 17,311,011 | 2.86 | 9.62 | 1.11 | 0.11 | 3.49 | 1,944,038 |

| 1.3 | 15,751,481 | 3.08 | 10.07 | 1.18 | 0.11 | 3.72 | 1,881,326 |

| 1.4 | 14,636,049 | 3.25 | 10.53 | 1.24 | 0.11 | 3.9 | 1,832,800 |

| 1.5 | 13,589,295 | 3.43 | 10.85 | 1.3 | 0.12 | 4.08 | 1,784,294 |

| 1.6 | 12,742,712 | 3.6 | 11.27 | 1.36 | 0.12 | 4.25 | 1,741,963 |

| 1.7 | 11,837,943 | 3.8 | 11.76 | 1.42 | 0.12 | 4.45 | 1,694,016 |

| 1.8 | 11,155,252 | 3.97 | 12.13 | 1.47 | 0.13 | 4.62 | 1,655,499 |

| 1.9 | 10,440,768 | 4.17 | 12.61 | 1.52 | 0.13 | 4.81 | 1,613,244 |

| 2 | 9,881,761 | 4.34 | 13.06 | 1.57 | 0.13 | 4.97 | 1,578,019 |

| 2.1 | 9,407,542 | 4.49 | 13.41 | 1.62 | 0.13 | 5.12 | 1,547,054 |

| 2.2 | 8,953,342 | 4.66 | 13.83 | 1.67 | 0.14 | 5.27 | 1,515,540 |

| 2.3 | 8,523,129 | 4.83 | 14.23 | 1.72 | 0.14 | 5.42 | 1,484,369 |

| 2.4 | 8,092,822 | 5.01 | 14.66 | 1.77 | 0.14 | 5.58 | 1,451,837 |

| 2.5 | 7,733,492 | 5.17 | 15.04 | 1.82 | 0.14 | 5.73 | 1,423,675 |

| 2.6 | 7,421,006 | 5.33 | 15.44 | 1.86 | 0.14 | 5.86 | 1,398,119 |

| 2.7 | 7,185,284 | 5.46 | 15.62 | 1.89 | 0.15 | 5.97 | 1,377,965 |

| 2.8 | 6,913,664 | 5.62 | 15.92 | 1.92 | 0.15 | 6.09 | 1,353,882 |

| 2.9 | 6,641,224 | 5.78 | 16.24 | 1.97 | 0.15 | 6.22 | 1,328,928 |

| 3 | 6,443,251 | 5.9 | 16.45 | 1.99 | 0.15 | 6.33 | 1,310,235 |

Note: Some rounding errors may be present

Foreign Estimates (Non-JORC)

La Mancha completed two tonnage and grade estimates in 2003 and 2006. The reported 2003 NI43-101 (non-JORC Code compliant) resource estimate for the Hualilan project is a measured resource of 299,578 tonnes averaging 14.2 grams per tonne gold plus an indicated resource of 145,001 tonnes averaging 14.6 grams per tonne gold plus an inferred resource of 976,539 tonnes grading 13.4 grams per tonne gold representing some 647,809 ounces gold. (Source: La Mancha resources Toronto Stock Exchange Release May 14, 2003 – Independent Report on Gold Resource Estimate)

| Category | Tonnes (kt) |

Gold Grade (g/t) |

Contained Gold (koz) |

Silver Grade (g/t) |

Contained Silver (koz) |

Zinc Grade (%) |

Contained Zinc (kt) |

| Measured | 163 | 12.7 | 67 | 52 | 275 | 2.5 | 4.1 |

| Indicated | 51 | 12.5 | 20 | 37 | 60 | 2.6 | 1.3 |

| Total of Measured & Indicated | 214 | 12.7 | 87 | 49 | 336 | 2.5 | 5.4 |

| Inferred | 214 | 11.7 | 81 | 46 | 319 | 2.3 | 4.9 |

| Total of Measured, Indicated & Inferred | 428 | 12.2 | 168 | 48 | 655 | 2.4 | 10.3 |

Source: La Mancha Resources Toronto Stock Exchange Release dated 14 May 2003 – Independent Report on Gold Resoruce Estimate. Rounding errors may be present. Troy ounces (oz) tabled here.

These estimates are foreign estimates and not reported in accordance with the JORC Code. A competent person has not done sufficient work to clarify the foreign estimates as a mineral resource in accordance with the JORC Code. It is uncertain that following evaluation and/or further exploration work that the foreign estimate will be able to be reported as a mineral resource.

To verify the foreign estimates CEL in accordance with the JORC Code the Company intends to develop a program to include:

- Twinning of core holes;

- Additional data precision validation as required;

- Detailed interpretation of known mineralized zones;

- Geostatistical assessment of area of currently defined mineralisation to complete a re-estimation of these areas;

- Investigate further drilling requirements to upgrade both the unclassified mineralisation and mineralisation in the existing historical resources to meet JORC 2012 requirements;

- Structural interpretation;

- Metallurgical test work; and

- Complete a resource model review to meet JORC 2012 requirements.